Travelling in Bolivia is an incredible adventure… but when it comes to money, it can quickly become a headache if you’re not well prepared. Between the capricious ATMs, the sometimes abusive bank charges and the uneven acceptance of cards, the choice of bank card is clearly strategic.

In this article, I share with you the best bank cards for traveling to Bolivia without fees, those I’ve tested or analyzed for travelers, as well as the best card + cash strategy to avoid unpleasant surprises on the spot.

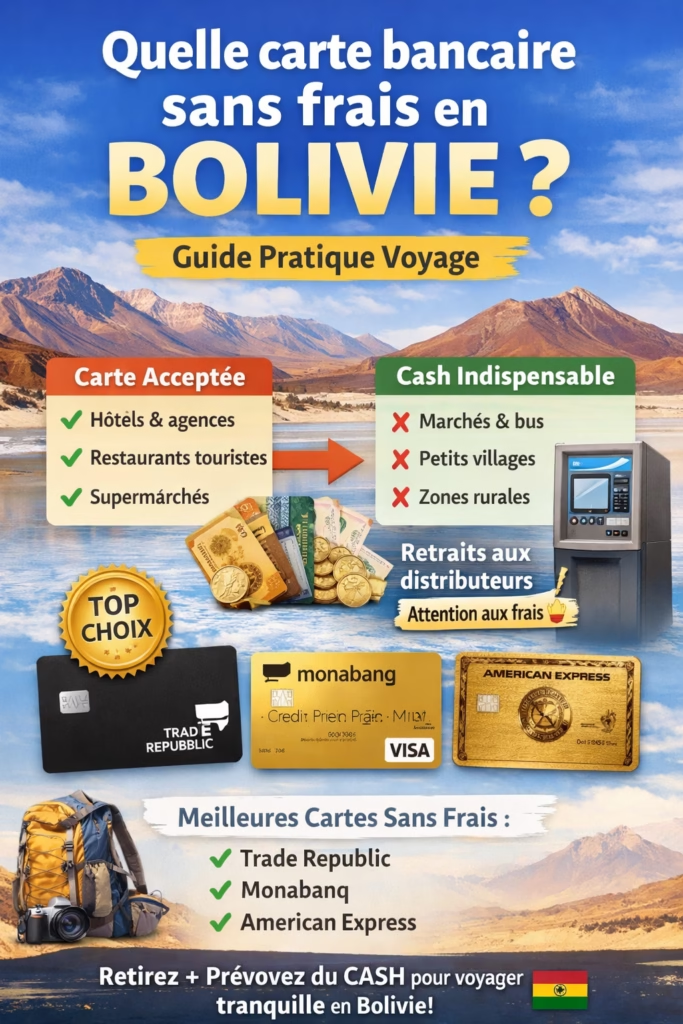

Can I pay by credit card in Bolivia?

Let’s be clear: Bolivia remains a very cash-oriented country.

Where credit cards are accepted

- Medium to high range hotels

- Travel agencies and tour operators

- Some tourist restaurants

- Supermarkets in major cities (La Paz, Santa Cruz, Sucre)

Where cash is essential

- Local markets

- Small restaurants

- Buses, cabs, colectivos

- Villages, rural areas, Altiplano

👉 Conclusion: in Bolivia, your bank card is mainly used to withdraw money, not to pay for everything.

Which cards are accepted in Bolivia?

- Visa: the most reliable

- Mastercard: also well accepted

- American Express: very limited acceptance

Even if some signs display the Amex logo, in reality, it doesn’t always work. In Bolivia, Amex should be seen as a secondary card, never the main one.

Bank charges in Bolivia: beware of the pitfalls

Here are the charges you may encounter:

- Foreign payment charges (up to 2-3%)

- Withdrawal charges abroad

- Fixed fee per withdrawal

- Bolivian bank commissions (often 15 to 30 BOB)

👉 Even with a “no-fee” card, distributors in Bolivia sometimes take their own commission. This is quite normal.

Vending machines in Bolivia

Some very concrete information:

- Ceiling often limited (1,000 to 2,000 BOB per withdrawal)

- Some banks refuse foreign cards

- Frequent breakdowns, especially outside major cities

- Not always tickets available

💡 Field tip: withdraw large sums at once when you find an ATM that works.

Which is the best no-fee bank card for Bolivia?

🥇 Trade Republic – the best map for traveling in Bolivia

Why it’s a great choice:

- Free foreign payments

- Real exchange rate

- Simple, effective card, perfect as a main card

- Ideal for withdrawals in Bolivia

Good to know:

- Not a “traditional” bank

- To be completed with an emergency card

👉 This is clearly the card I’d most recommend for Bolivia.

Monabanq – a good alternative for Bolivia

Advantages:

- Reassuring French bank

- International card

- Solid customer service

- Cash withdrawals in Bolivia

Disadvantages:

- Less competitive than a neobank on fees

- Not the most optimized for long-distance travellers

👉 Good solution if you want to stay with a classic bank while traveling in Bolivia.

American Express Gold – useful as a complement in Bolivia

Let’s be honest: Amex is not ideal as a main card in Bolivia.

On the other hand, it is excellent for :

- Travel insurance

- Repatriation

- International flights

- Some high-end hotels

👉 To be used before and after your trip, or as an emergency card, but not for everyday life in Bolivia.

The best banking strategy for Bolivia

🎯 The ideal combination:

- Trade Republic → main map

- Monabanq or Amex → secondary card

- Cash in bolivianos at all times

How much cash do you need?

- Still the equivalent of 3 to 5 days’ expenses

- More if you go to remote areas

Before traveling to Bolivia

Before departure :

- Tell your bank

- Increase your ceilings

- Activate international payments

- Note opposition numbers

- Scan your cards

On site:

- Removes during the day

- Avoids isolated dispensers

- Never rely on a single card

To sum up: which bank card should I choose for Bolivia?

👉 Best choice: Trade Republic

👉 Good alternative: Monabanq

👉 Excellent complement: American Express Gold

Bolivia is a magical destination, but cash is still king. With the right bank card and a minimum of forethought, you’ll travel with a clear head… and without unnecessary charges.